Why banks & insurance companies fail without ISMS & DSMS

Cyberattacks, GDPR fines and loss of reputation – banks and insurance companies must prioritize information security and data protection. Find out more with practical solutions for compliance and information security.

Secure & conform

How 4conform makes banks & insurance companies fit for DORA, NIS2 and ISO27001 with ISMS & DSMS

An ISMS & DSMS protect banks and insurance companies from fines, data leaks and loss of reputation. Find out how you can efficiently implement compliance and security and optimally protect yourself against cyber attacks!

Banks and insurance companies are under pressure. Cyberattacks on customer data, stricter regulations such as DORA and NIS2 and the GDPR require robust solutions. An integrated ISMS and DSMS not only protects against fines, but also ensures future viability. Automated risk analyses, AI-supported incident response and compliance workflows minimize risks efficiently – without manual effort.

By combining information security and data protection, financial institutions strengthen their resilience, meet regulatory requirements and gain customer trust. Turn security into a competitive advantage with a solution that combines DORA, NIS2 and ISO27001.

ISMS Live

Take a look at our ISMS in action

As the person in charge of information security, one of the challenges you face is managing risks quickly and efficiently without losing sight of the big picture.

This is exactly where we come in – not at some point, but now. See for yourself in our short video or the guided tour on Webinar Geek.

Cyberattacks, data protection & compliance

Key risks for banks and insurance companies

Cyber attacks & IT security risks

Banks and insurance companies are the main targets of ransomware, phishing and DDoS attacks that encrypt customer data or paralyze systems. Cyber criminals are using AI for more precise attacks, while outsourcing to IT service providers is creating new vulnerabilities. According to the BSI, the threat level is “higher than ever”.

Business interruptions & system failures

IT failures due to hacks, faulty updates or third-party risks jeopardize critical systems such as online banking or policy management. Global IT disruptions (e.g. 2024) show how networked infrastructures can paralyze entire financial markets.

Data protection breaches & compliance risks

Unsecured customer data leads to GDPR fines (up to 4% of turnover) and NIS2 penalties. Banks must demonstrate data minimization, deletion concepts and accountability – especially for cloud migrations and credit checks.

Reputational damage & loss of trust

Media reports about data leaks trigger mass withdrawals, while rumors about security breaches damage brand image in the long term. Cyber incidents undermine confidence in financial stability.

Financial losses & extortion costs

Ransom demands, business shutdown costs (up to €100,000/h) and fines are a burden on the balance sheet. Cyber insurance policies often do not cover ransoms, which makes payments risky.

Regulatory sanctions & license risks

Verstöße gegen DORA, BAIT/VAIT führen zu Auflagen oder Lizenzentzug. Unzureichende KRITIS-Meldungen (NIS2) kosten bis 10 Mio. € Strafe, Zertifizierungsverluste blockieren Cloud-Projekte.

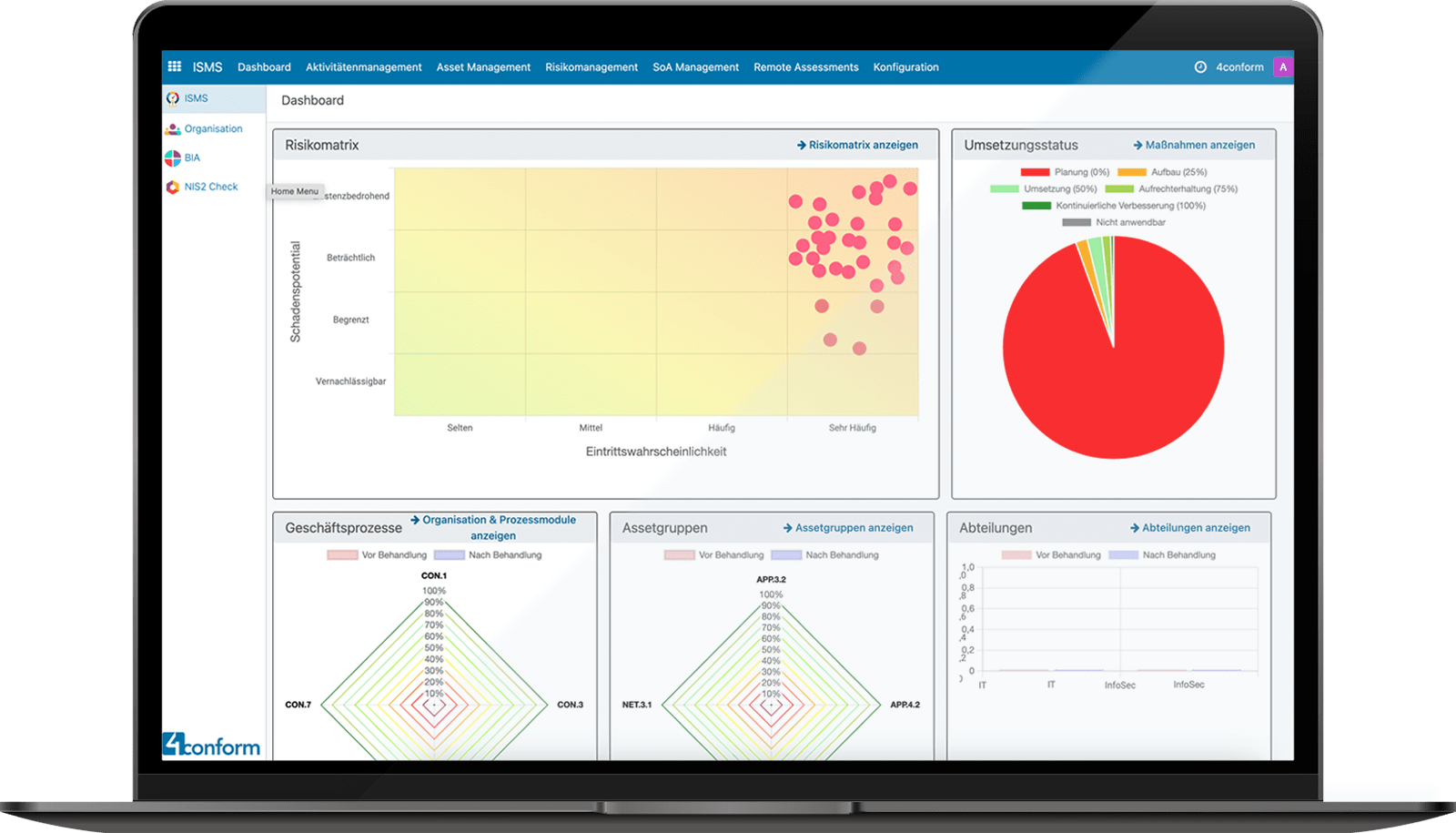

Take back control of your cyber security with 4conform ENTERPRISE ISMS. Our comprehensive solution helps you build a robust and customized information security management system that detects threats early, protects your critical infrastructure and helps you meet complex regulatory requirements.

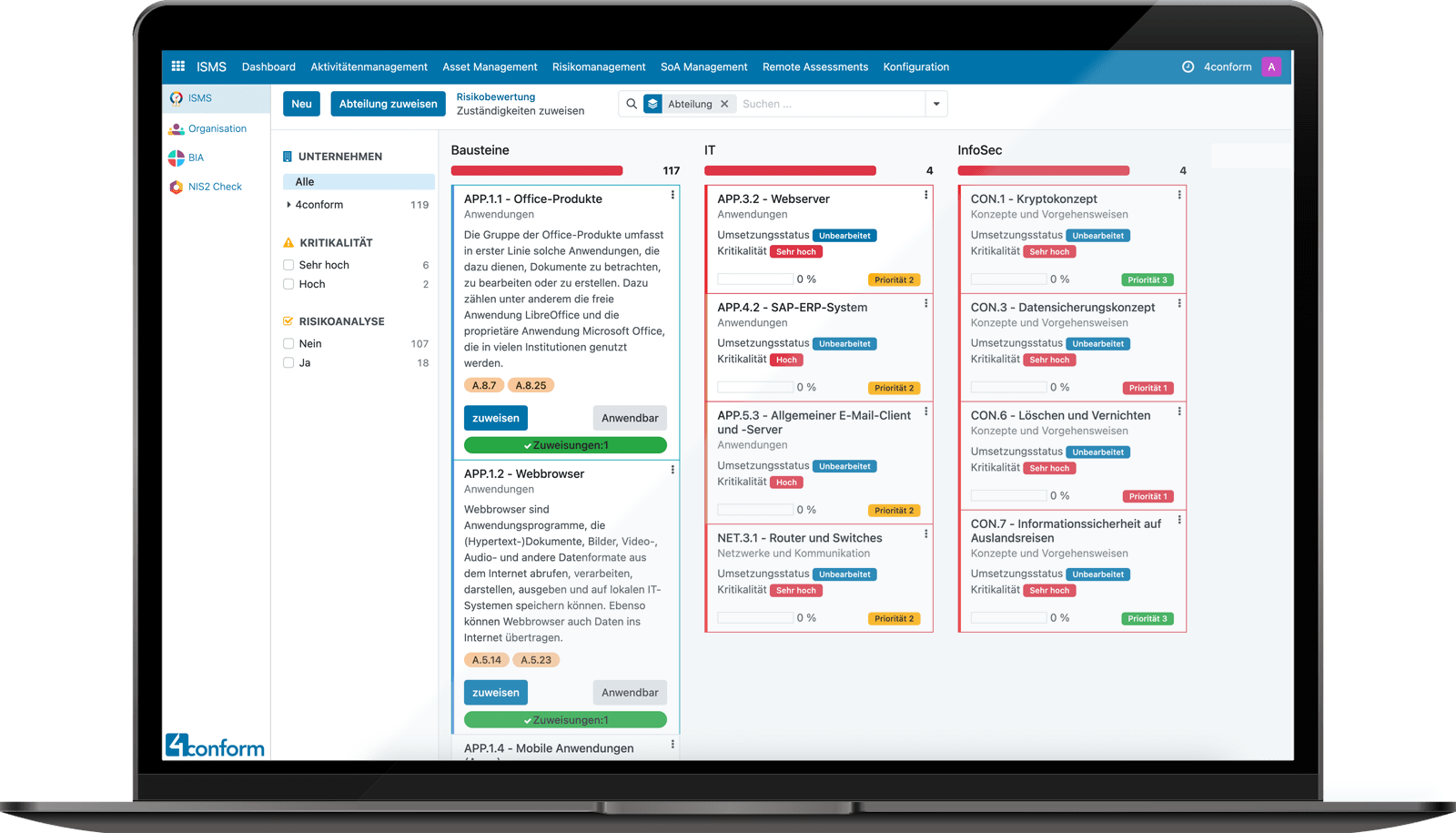

Keep an eye on all departments and their risks.

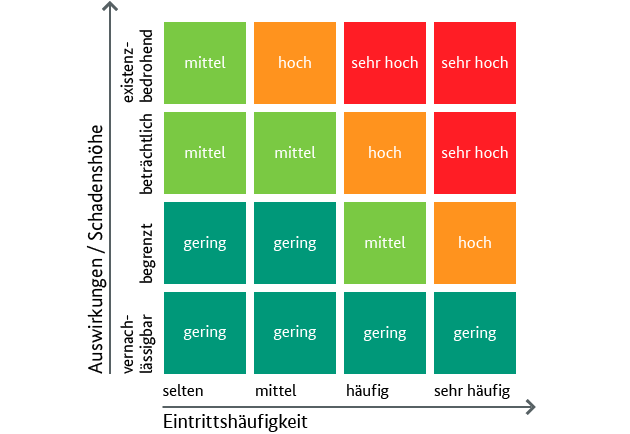

Classify your risks with the help of the BSI risk matrix.

The risk matrix in the 4conform ENTERPRISE ISMS dashboard

Information security

How can our ISMS help?

The security of sensitive data and critical processes is vital for banks and insurance companies. The 4conform ENTERPRISE ISMS software offers an efficient safety net for this: it identifies risks preventively – from cyber attacks to system failures.

Imagine being able to detect threats such as ransomware or compliance breaches at an early stage and handle them correctly. In an industry where data flows and regulatory requirements are complex, this is essential.

With 4conform, you protect yourself against financial losses, maintain the trust of your customers and ensure smooth operations.

BSI basic protection included

Start your ISMS without detours! Our 4conform ENTERPRISE ISMS software contains all relevant BSI basic protection modules with the corresponding measures.

This means you can get started right away. Rely on a proven solution that saves you time, resources and headaches. Secure your company with an ISMS that has been developed by experts and meets the highest standards.

What benefits does an ISMS offer?

4conform ENTERPRISE ISMS is used specifically to make managing your information security easier and more efficient. It serves as a central platform to support processes relating to information security, risk and compliance management.

Data protection

How can our DSMS help you?

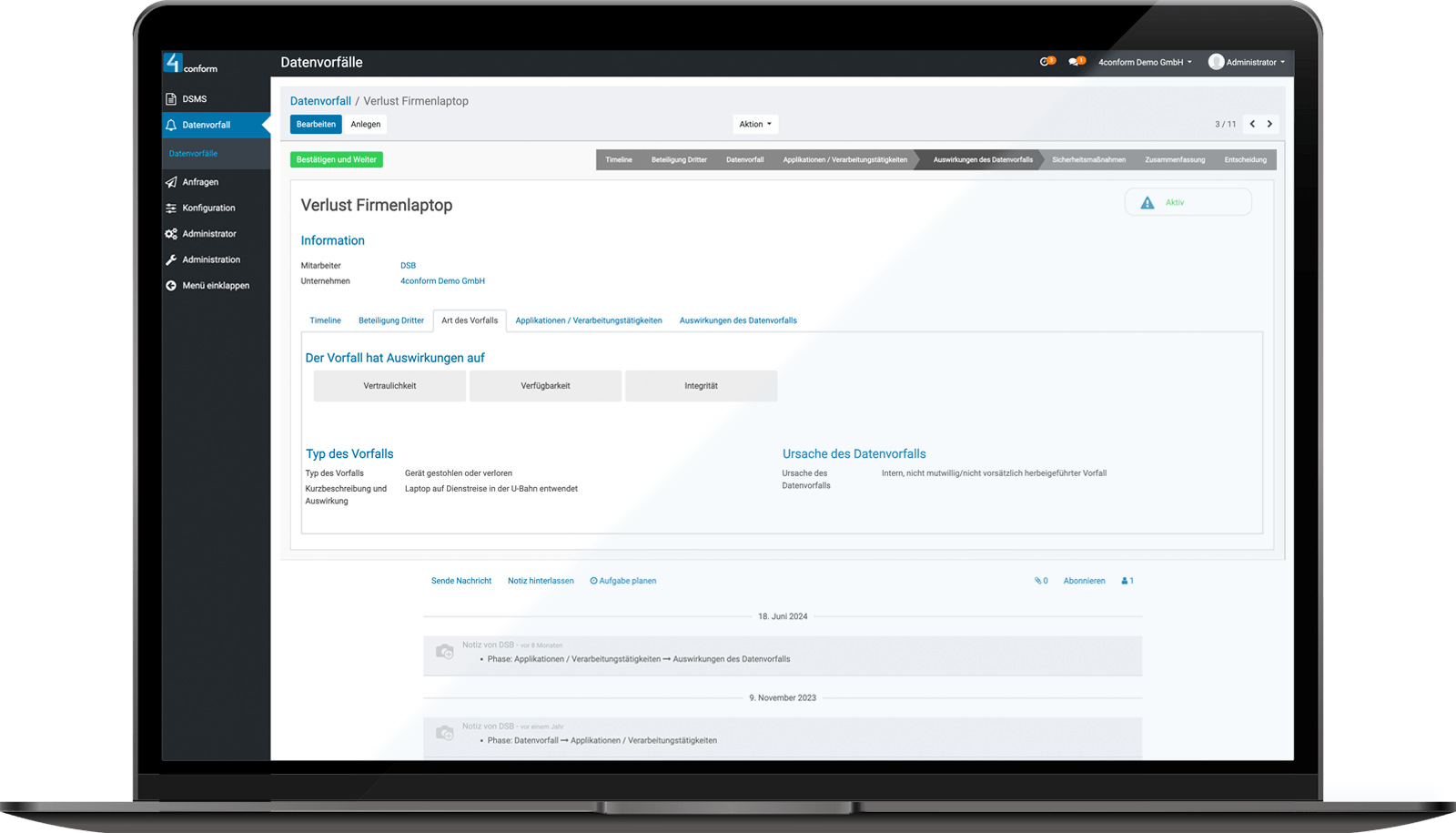

A comprehensive data protection management system (DSMS) is essential for financial institutions such as banks or insurance companies in order to protect sensitive customer data and transaction information in compliance with the GDPR. The ENTERPRISE DSMS from 4conform ensures that all data processing procedures – from credit checks to claims settlement – are legally compliant and transparent.

A DSMS strengthens the trust of customers and supervisory authorities, reduces liability risks due to compliance gaps and protects against reputational damage in the event of data leaks. Banks and insurance companies can thus not only meet DORA and NIS2 requirements, but also secure long-term business relationships through verifiable data security.

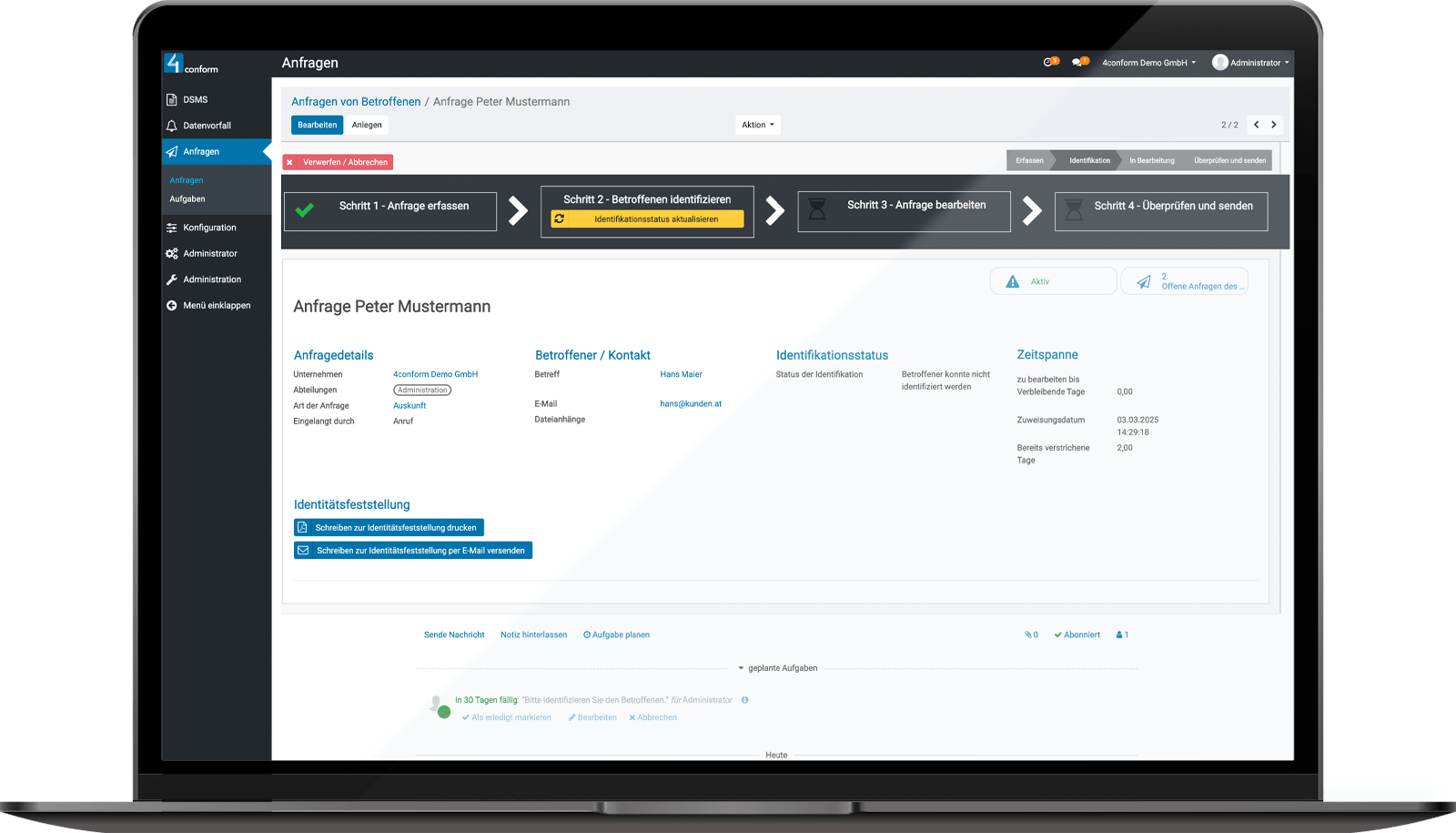

Process data incidents easily and in compliance with the law in ENTERPRISE DSMS.

Manage and process your data subject requests in accordance with the legal requirements.

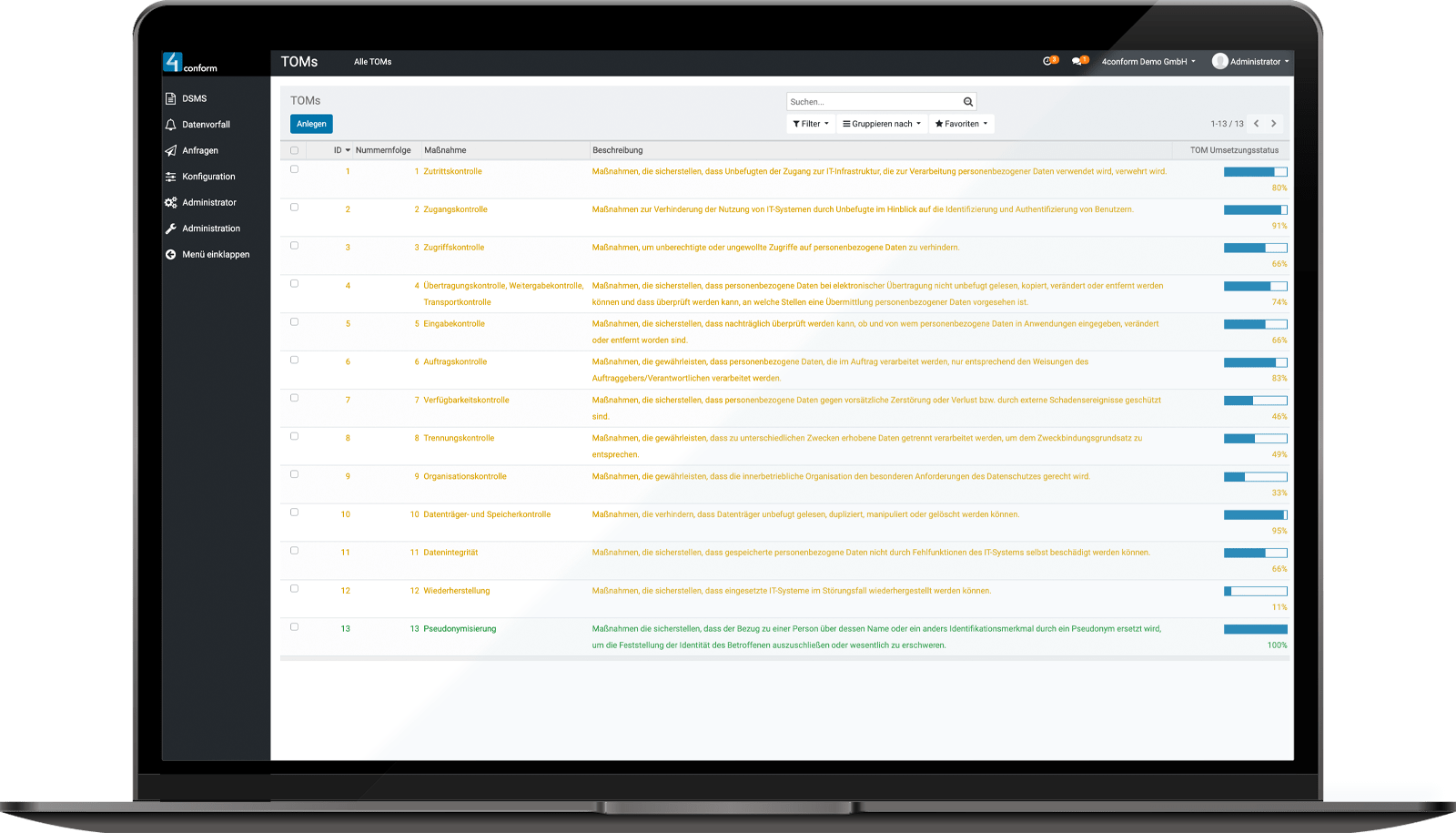

Map out your technical and organizational measures.

DSMS Live

Take a look at our DSMS in action

Book a demo now and find out how you can efficiently ensure the protection of sensitive data and meet legal requirements. In your demo appointment, we will show you how easy it is to integrate data protection into your company. Save your appointment and start into a more secure future!

What benefits does a DSMS offer?

Our ENTERPRISE DSMS software (data protection management system) is primarily used to ensure the protection and management of data in an organization. It focuses on compliance with data protection and data security regulations and the prevention of data breaches.

“Information security and data protection are existential for banks and insurance companies – in the face of ransomware that paralyzes payment systems and fines in the billions. Our ISMS and DSMS create a crisis-proof infrastructure that ensures compliance and proactively fends off attacks.

The future belongs to those who use security as a strategic lever for customer satisfaction, lower risk costs and an unassailable reputation. 4conform supports you in this.”

Full security with 4conform

Information and data security is a complex topic. But it doesn’t have to be complicated. Get to know our smart GRC and information security solutions and arrange a non-binding initial consultation.